arkansas estate tax statute

Online payments are available for most counties. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc.

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas has 46500 farms covering 143 million acres according to the Department of Agricultures 2007 survey of state farming.

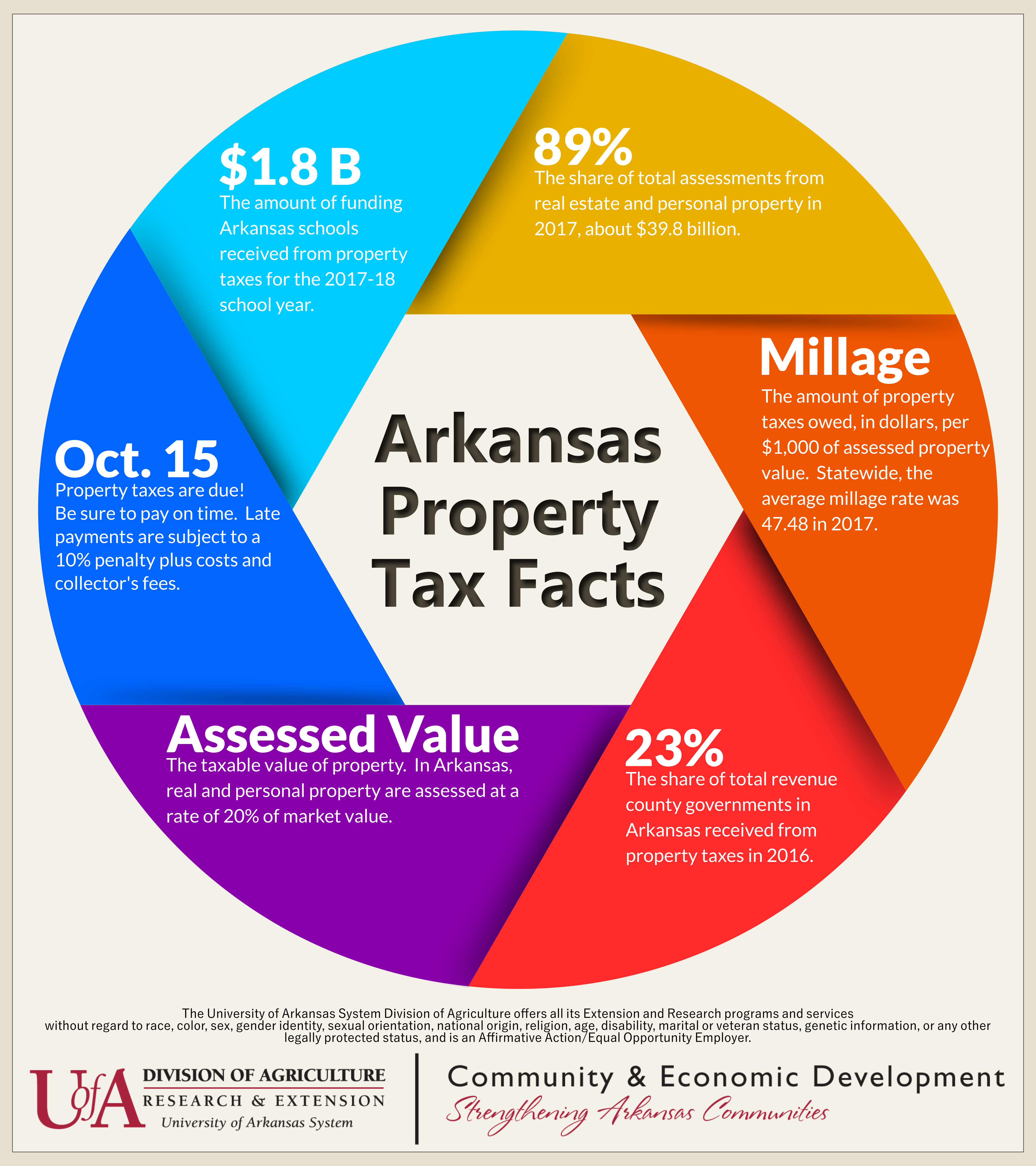

. 2 All taxes unpaid after October 15 are delinquent. Business firms and individuals are subject to annual property tax on all real and personal property. According to Amendment 79 the taxable value cannot exceed.

Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. Because Arkansas taxes based on 20 percent of assessed value 25 mills is essentially equivalent to 05 percent of propertys value. Arkansas military retirement pay is exempt from state taxes.

The full text of Act 141 can be accessed HERE. The full text of Act 141 can be accessed HERE. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. The tax is calculated based on 20 of the market value of real and personal property and the average annual value of merchants stocks andor manufacturers inventories based on millage rates in individual school districts. Market Value - ACA.

Arkansas tax laws have evolved in recent years to recognize the importance of local farms to the state economy. Select Popular Legal Forms Packages of Any Category. Homestead and Personal Property Tax Exemption.

Fiduciary and Estate Income Tax Forms 2022. While the property tax rate varies widely across different parts of the country they fall into the 1-5 range. Specifically Amendment 74 to the Arkansas Constitution narrowly approved by voters in 1996 requires all school districts to set a minimum 25 mills property tax.

Arkansas property tax laws. Fayetteville Arkansas calculates its property taxes by requiring property owners to pay a set percentage of the appraised value. Personal Property - Under Arkansas law ACA.

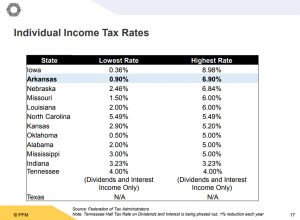

Homestead and Personal Property Tax Exemption. Arkansas like other states has what is known as a progressive tax system in which higher income individuals pay a higher percentage of their income in taxes while those with less income pay a smaller percentage. Chat With A Trust Will Specialist.

Arkansas disabled veterans who have been awarded. These 5 and 10 caps do not apply to. The highest marginal tax rate in Arkansas is 7 percent.

A 1 All taxes levied on real estate and personal property for the county courts of this state when assembled for the purpose of levying taxes are due and payable at the county collectors office between the first business day of March and October 15 inclusive. 26-1-101 personal property is defined as Every tangible thing being the subject of ownership and not forming a part of any parcel of real property as defined. In order to impose this tax the government of Fayetteville Arkansas initially has to decide the.

The tax rate is 330 per 1000 of actual consideration on transactions that exceed 100. 10 a year until the propertys full assessed value is reached. Pay-by-Phone IVR 1-866-257-2055.

Real Estate The Real Property Transfer Tax is levied on each deed instrument or writing by which any lands tenements or other realty sold shall be granted assigned transferred or otherwise conveyed. Rv salvage yard phoenix arizona. All Major Categories Covered.

AR4FID Fiduciary Interest and Dividends. AR1002ES Fiduciary Estimated Tax Vouchers for 2022. Built By Attorneys Customized By You.

Act 141 of Arkansas 91 st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes effective 1 January 2018. Arkansas military retirement pay is exempt from state taxes. Arkansas disabled veterans who have been awarded.

Act 141 of Arkansas 91 st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes effective 1 January 2018. What does current period mean. 26-26-1202 states that personal property of any description shall be valued at the usual selling price of similar.

Limit for Other Properties eg commercial vacant or agricultural 5 a year until the propertys full assessed value is reached.

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Learn More About Arkansas Property Taxes H R Block

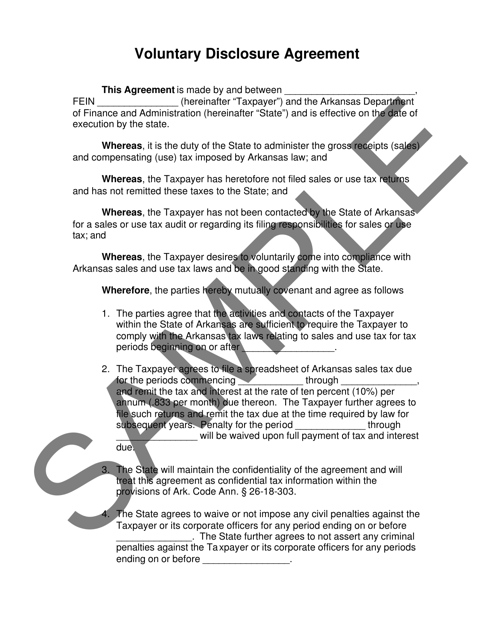

Arkansas Voluntary Disclosure Agreement For Sales Tax Download Printable Pdf Templateroller

Legacy Assurance Plan Pointing About The Federal Estate Tax And How This Tax May Affect Larger Estate Planning Estate Planning Checklist Revocable Living Trust

Recreational Land For Sale 2009 Harmon Street Blytheville Ar 72315 Usa Blytheville Arkansas 72315 Price 990 In 2022 Land For Sale Lots For Sale Blytheville Arkansas

Arkansas Inheritance Laws What You Should Know

The Ultimate Guide To Arkansas Real Estate Taxes

Understanding Your Arkansas Property Tax Bill

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Arkansas State Tax Guide Kiplinger

Eliminating Its Income Tax Will Help Arkansas S Economy

10 New Laws To Know About In 2022

Arkansas Estate Tax Everything You Need To Know Smartasset

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Eliminating Its Income Tax Will Help Arkansas S Economy